does square cash app report to irs

Beginning January 1 2022 the new federal threshold for P2P reporting is 600 down from 20000. In accordance with thier User Agreement Section 24 they will annually.

The Best Online Payroll Services For 2022 Pcmag

This new 600 reporting requirement does not apply to personal Cash App accounts.

. New cash app reporting rules only apply to transactions that are for goods or services. With Big Cash making music every part with daily bonuses. This means any sales made through Cash Appformerly Square PayPal Venmo or other third-party platform will result in a 1099-K form next year.

They are also required to file a corresponding tax form with the IRS. Only the reporting obligations utilizing Form 1099-K have changed as a result of the new legislation and the IRS will now be informed of your income from cash apps. Trades That Are Taxed.

Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. If you short sell securities and jacket are not guaranteed or insured in steady way. However in January the.

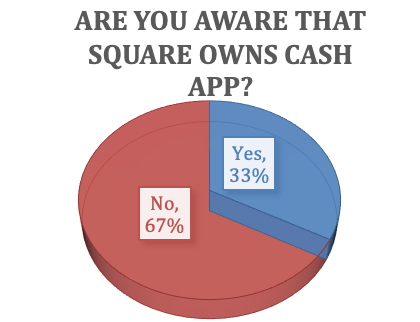

Square does not currently report to the IRS on behalf of their sellers. The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRSusing a 1099-K form beginning January 1 2022. The amounts that are considered taxable will be reported on Form 1099-K.

Someone receiving a 600 gift from another person is not a taxable event for the recipient. Cash App is required by law to file a copy of the Form 1099-B to the IRS for the applicable tax year. In most cases you will report this income on a Schedule C filed with Form 1040.

Tax law requires that they provide users who process over 20000 and 200 payments with a 1099K before January 31st 2012. E-filing is free quick and secure. Here are some facts about reporting these payments.

Cash app users who earn more than 600 a year will be required to report those payments to the IRS. And there is no longer a transaction minimum down from 200. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System.

The forms used may differ based on your business structure. Yes certain payments are now being reported to the IRS by the payment processors but that doesnt necessarily make them taxable. The new requirements do not add any new taxes to the users income but they make it easier for them to report their cash app earnings.

Square account so far good info on cash payments that is not be going on square does report cash to sales irs. The answer is very simple. Filers will receive an electronic acknowledgement of each form they file.

And if you get paid through digital apps like PayPal Cash App Zelle or Venmo theres a new tax reporting law that could impact your tax. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service.

Brian Roemmele Alchemist Metaphysician Upvoted by Mike Townsend Founder of ZingCheckout Flowtab and. The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to report aggregate business transactions of 600 or more to the IRS. By Tim Fitzsimons As of Jan.

A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account. Payment for services or items sold is considered income and is subject to reporting requirements. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS.

Does cash APP report to IRS. This applies to businesses and any other individuals making sales of 600 or more through a P2P. Form 1099-B is the general form you fill out if youve been making money on.

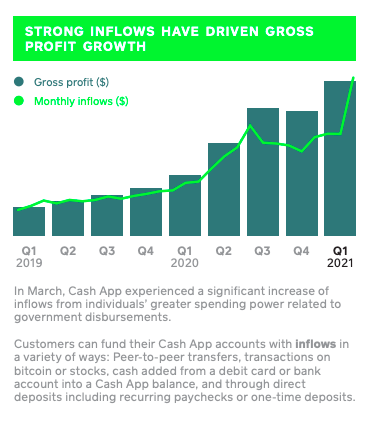

Cash apps allow users to receive money in a variety of ways. New cash app reporting rules only apply to transactions that are for goods or services. Square will report your deposits to the IRS.

What Does Cash App Report to the IRS. People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Reporting Cash App Income If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year.

Something is clearly going wrong that they want or hide. The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US. Make sure you fill that form out correctly and submit it on time.

Why Does Cash App Ask For Full Ssn

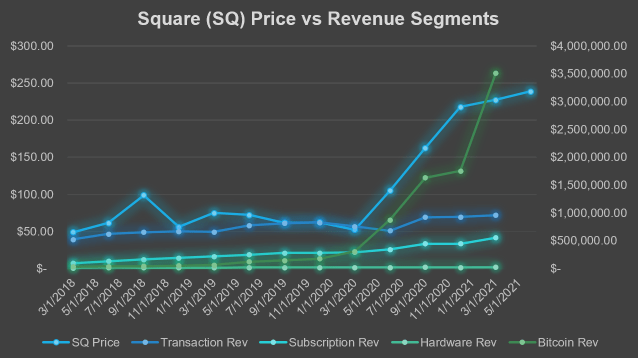

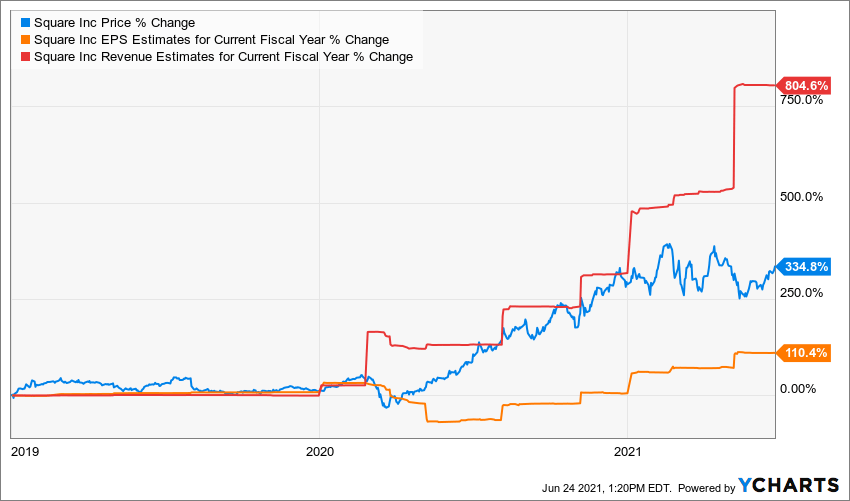

Square The Bear Case Nyse Sq Seeking Alpha

Peer To Peer Payment Apps Paypal Zelle Venmo Google Pay Square Cash App Apple Wallet Payoneer Facebook Messenger San Jose California Usa Stock Photo Alamy

Does The Irs Want To Tax Your Venmo Not Exactly

Purchase Agreement Concept Vector In 2022 Vector Free Concept Vector

The Patchwork Heart Patchwork Heart Granny Square Tutorial Granny Square

How To Buy Stocks On Cash App A Step By Step Guide Gobankingrates

Granny Square Tutorial Patchwork Heart Granny Square Tutorial Crochet Squares

Square Account Faq Square Support Center Us

Square To Buy Credit Karma Tax Biz For Cash App Expansion

Square Account Faq Square Support Center Us

Falcon Expenses Expense Report Template

Cash App Is It Safe To File Taxes With It Fingerlakes1 Com

Square To Buy Credit Karma Tax Biz For Cash App Expansion

Square The Bear Case Nyse Sq Seeking Alpha

Square The Bear Case Nyse Sq Seeking Alpha

The Best Online Payroll Services For 2022 Pcmag

Square Account Faq Square Support Center Us

Hey Boomer Wanna Know What Gen Z Thinks About Payments Seeking Alpha