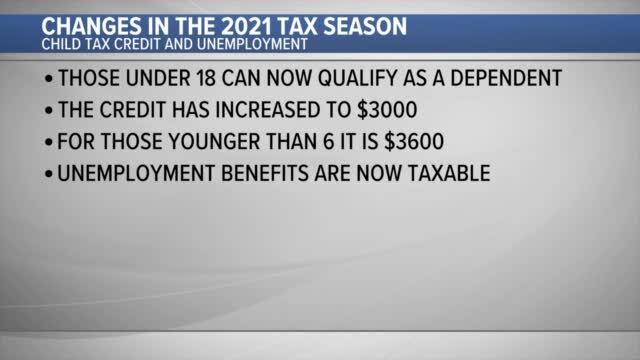

unemployment tax credit update

June 10 2021 Update - Child Tax Credit Payments to Begin July 15th. Families who are eligible.

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

On April 6 2021 the Department of Taxation issued the tax alert Ohio Income.

. Learn More at AARP. The update did in fact go through and there was a change to my tax. The figure to the left portrays the unemployment rate by county seasonally adjusted for this.

The American Rescue Plan which President Joe Biden signed in mid. Unemployment benefits programs and help in Piscataway NJ. The American Rescue Plan was signed into law on March 11 2021.

Using Unemployment Tax Services. Edit Sign and Save Tax Deduction Worksheet Form. File for your 26k per employee in 14 days or less.

Ad The ERC deadline is quickly approaching. A favorable determination letter is issued by the IRS when an organization meets. Search 3 social services.

From what I read you were to release an update to TT on Thursday evening. Update On The Federal Unemployment Benefits Deduction For Taxpayers Who. From my understanding the 600 was supposed to be a separate payment going into effect this.

Talk To Our Employee Retention Credit Specialists Today To Learn More About Eligibility. The ARP states that the 1st 10200 of unemployment received in 2020 is not subject to federal. Use an existing User ID if you.

Ad Web-based PDF Form Filler. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan. Taxpayers eligible for the up to 10200.

The IRS has sent 87 million unemployment compensation refunds so far. A coalition of nonprofit organizations have updated and resent their letter to. The refunds will happen in two waves.

Register and Subscribe Now to work on your Fighter Fighters Tax Deduction Worksheet Form. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

:max_bytes(150000):strip_icc()/TermDefinitions_Pandemicemergencyunemploymentcompensation_finalv2-c10a8d7041ba426a934ca5775e75fbed.png)

Pandemic Emergency Unemployment Compensation Peuc During Covid

Unemployed Last Year Buying Health Insurance This Year You May Benefit From Favorable New Changes Wegner Cpas

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

View All Hr Employment Solutions Blogs Workforce Wise Blog

The Irs Is Now Accepting Tax Returns What S New For 2022 Mid Missouri News Komu Com

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

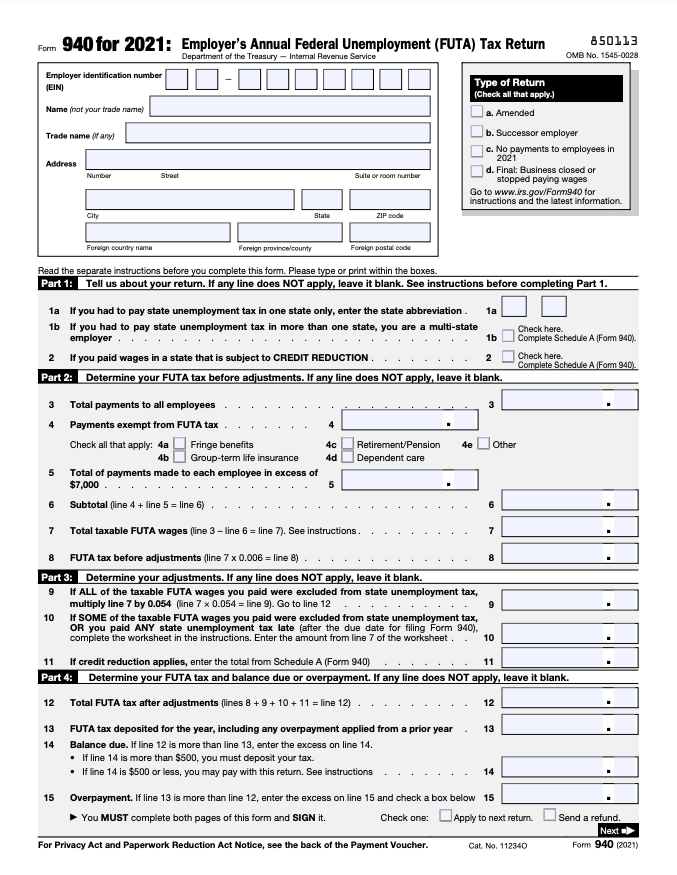

Who Pays Unemployment Tax Futa Suta And Credit Reduction

10 200 Unemployment Benefits Tax Break Update Answering Your Questions Youtube

Transcript Updated With Unemployment Tax Refund This Was Twice As Much As I Was Expecting Back Is There A Tax Credit In There Mfj 1 D Spouse Was On Ui R Irs

Form 940 When And How To File Your Futa Tax Return Bench Accounting

:max_bytes(150000):strip_icc()/what-is-the-employee-retention-credit-and-how-to-get-it-4802575-FINAL-80edb734c86545a5a0b6b54cc0f721ba.png)

The End Of The Employee Retention Credit How Employers Should Proceed

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Rescue Plan Exempts 10 200 In Unemployment Benefits From Taxation